THE BALUSSERY BENEFIT CHIT FUND PVT. LTD Personalised service and guidance to subscribers for planning their financial requirements.66, Singarachari Street, Triplicane,Chennai-600 005.,

THE BALUSSERY BENEFIT CHIT FUND PVT. LTD

Personalised service and guidance to subscribers for planning their financial requirements.

Chennai Centre Contact Details

Balussery Buildings ,

66, Singarachari Street, Triplicane,Chennai-600 005.,

Ph # 2844 1678/2844 1194 Fax # 2844 3115

Email:chennai@balusserychits.com

Branch office

69, Radha Nagar Main Road,1st Floor (Above Tata Docomo Office),

Chromepet,Chennai- 600 044

Mobile # 8939391935

Branch Timings : 9.30 am to 6 pm (Monday to Saturday)

About us

Balussery was established in 1947. Our growth over the years has been found on

providing good value products, backed up by a high quality personal service. This has

enabled us to fulfill the mission of helping people achieve financial security. We are very

proud of the fact that the majority of our members benefited from money saved by

the members themselves!

Our Values

Our values help to build a culture of fairness in all our dealings with customers and the

wider community. We aim to live by these values in everything we do, ensuring that we

give you the best experience we possibly can.

We:

Are passionate about success.

Act with integrity and respect.

Strive to deliver quality and excellence.

Value people as individuals

Treating you fairly.

We believe in providing good value, transparent products and a professional, efficient

service. We also believe in treating all our customers fairly and we make sure we do this

by:

Having well trained, competent and professional staff

Encouraging all our staff to embrace our core values in their behavior

Providing plans that meet the needs of our customers

Keeping our customers properly informed before, during and after they take a chit plan with Balussery

Complying fully with the letter and spirit of all relevant legislation and codes of practice

Insisting that all our communications and promotions are clear, fair and not misleading

Monitoring our operations through comprehensive measures and controls.

COMPANY

A pioneer in Chit Funds, Balussery Chit Fund, managed by a Board of Directors, has contributed in no small measure to the growth of the industry. That’s BALUSSERY. Stable and Prudent.

Our values help to build a culture of fairness in all our dealings with customers and the wider community. We aim to live by these values in everything we do, ensuring that we give you the best experience we possibly can. We grow because you grow. We:

- Are passionate about success

- Act with integrity and respect

- Strive to deliver quality and excellence

- Value people as individuals

What is a Chit Fund?

chit Funds Concept of Chit Fund:

The Chit Fund concept is a totally Indian concept but the system has now won universal acclaim. It is a fraternity fund which is a ‘2 in1’ savings cum lending instrument.

History of Chits:

In the villages of Kerala, many centuries ago, a small group of farmers operated a unique scheme. Each farmer gave a fixed quantity of grains periodically to a selected TRUSTEE. The Trustee, after keeping aside a portion for himself, gave the rest to a member of the group to help him to meet his social commitments and other needs.

The farmer who received the lot continued to give the fixed quantity till every member of the group received his lot.

The additional benefits when receiving the lot earlier led to competition. Some members were even willing to forgo a certain portion (like a discount) of the lot, in order to get an earlier chance. So, an auction was held and the highest bidder got the lot. This was the basis of what we know today as the “Chit Fund Scheme”

The Chit Company’s Responsibilities

The Chit Company forms different groups among its fraternity. Each consists of a certain number of subscribers. They agree to contribute a specific amount as installment for a certain number of months.

As soon as the group is complete and the Government Certificate of Commencement is secured, an auction is held. On the date of the auction, the subscribers in the particular group assemble, either in person or through proxy. They bid for the amount and the person offering the highest discount receives the chit amount. Out of the discount foregone, the Company’s commission (5% of the chit amount) is deducted and the balance is divided equally among the subscribers in the group. The subscribers then deduct the dividend and pay only the balance in their next installments.

Before the successful bidder draws the amount, he proposes securities – immovable properties, Life Insurance Policies, Debentures of good companies, Unit Trust of India Certificates, Bank Guarantee etc. Personal sureties of persons employed in government offices, government undertakings and reputed public limited companies are also accepted. The prize amount is given as soon as the securities/sureties are accepted.

Why Chit Fund

Chit funds have been playing a stellar role even before the advent of modern banking era, in coming to rescue of the needy at affordable terms.

This system has numerous built-in advantages due to which people prefer this option over other formal institutions. These are:

Tax Free Dividend

Easy Accessibility

User-friendly service

Absence of latent cost

No Periodic interest hikes

Exit Options with nominal charges

“The subscribers trust us to take care of their hard-earned money and realize, they can bank on us when in urgent need of funds for any purpose, be it Medical, Education, Marriage, House Purchase, Travel etc.,” says Mr. M.V. Vaidyanathan, Director. He adds that “Though chit fund is equally popular across all categories, whether salaried, business or even housewife, it is the Small & medium entrepreneurs who reap the maximum benefits of chit funds for their business start-up, expansion as well as working capital, as unlike banks, we are much more supportive and understand their needs and try to service it in a quick & efficient manner”.

“Other frequent users of this financial intermediary, he continues, are those who get access to finance from banks & other institutions but need chit funds for the purpose of margin money, down payment, seed money etc, as banks & other financiers seldom grant loan for the full amount. This tool is of immense benefit for those who have the repayment capacity but are stuck due to some dumb policies of banks. So chit funds act as Step 1 for availing other loans”.

How Chit Fund Helps?

Chit Funds have the advantage both for serving a need and as an investment. Money can be readily drawn in an emergency or could be continued as an investment.

Interest rate is determined by the subscribers themselves, based on mutual decisions and varies from auction to auction.

The money that you borrow is against your own future contributions.

The amount is given on personal sureties too; unlike in banks and other financial institutions which demand a tangible security.

Chit funds can be relied upon to satisfy personal needs. Unlike other financial institutions, you can draw upon your chit fund for any purpose – marriages, religious functions, medical expenses, children’s education, etc.

Cost of intermediation is the lowest.

Chit fund is a saving cum borrowing instrument, which is unique when compared to other financial systems. When you invest in chits you get more return as compared to other Financial Intermediaries and when you borrow you pay less interest?

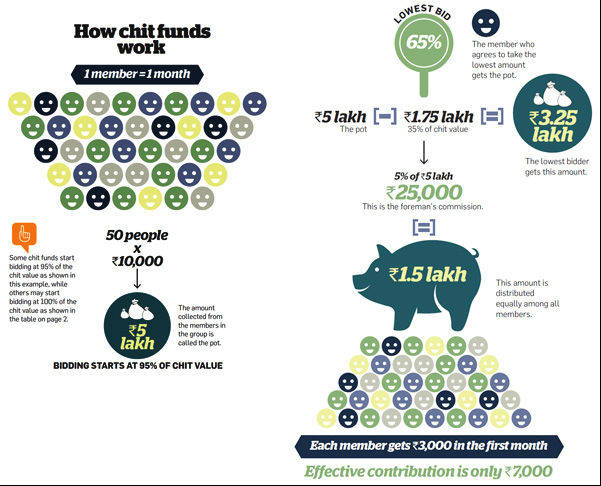

How Chit Fund Works

A chit scheme generally has a predetermined value and duration. Each scheme admits a particular number of members (generally equal to the duration of the scheme), who contribute a certain sum of money every month (or everyday) to the ‘pot’. The ‘pot’ is then auctioned out every month. The highest bidder (also known as the prized subscriber) wins the ‘pot’ for that month. The bid amount is also called the ‘discount’ and the prized subscriber wins the sum of money equal to the chit value less the discount and the fixed fee to the foreman. The discount money is then distributed among the rest of the members (or the non-prized subscribers) as ‘dividend’ and in the subsequent month, the required contribution is brought down by the amount of dividend.

To illustrate the above, let us consider an example of a chit scheme with the following characteristics. Chit Value = Rupees Rs.500000, Duration = 50 months and Members = 50. The contribution in this case would be initially Rs.10000 per month per member. In the first month, the collection would, therefore, be Rs.10000 multiplied by the number of members i.e. Rs.500000. This amount is called the ‘pot’ which is auctioned out at the end of the month. Now let us assume that the highest bid in the first month auction is Rs.100000. This is called the ‘discount’. The highest bidder now gets the amount equal to the chit value, less the discount, less 5% commission to the foreman, i.e. Rs.375000. The discount amount is then divided among the 50 members equally (the dividend for the 50 members work out to roughly Rs.2000 each). For the subsequent month, therefore, the contribution of these members reduces by the amount of dividend (i.e. the contribution in the second month for the members would be Rs.8000. This process gets repeated for all months till the end of the scheme. The contributions are the same for each member, but the total amount taken out or bid by each member varies.

In case of default or delayed payment, the Chit Fund organizer has to put up the liquidity on behalf of the defaulting and delaying members.

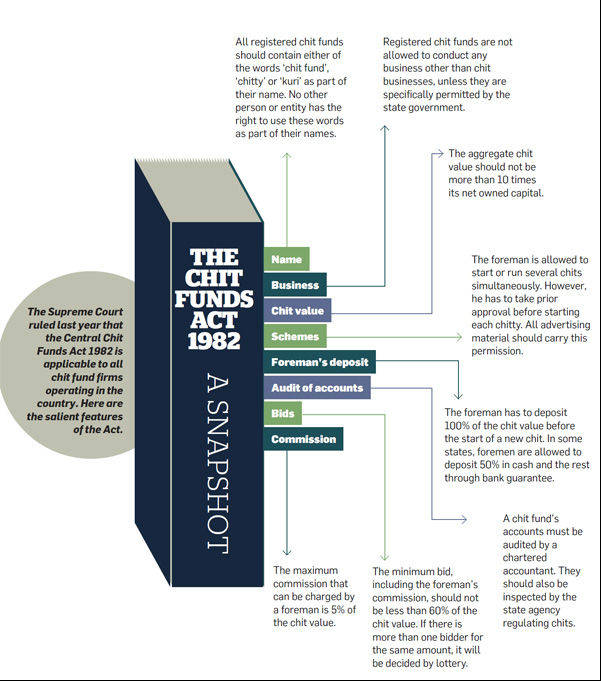

THE CHIT FUNDS ACT, 1982 Act. No. 40 of 1982

An Act to provide for the regulation of chit funds and for matters connected therewith

BE it enacted by Parliament in the Thirty-third Year of the Republic of India as follows –

CHAPTER 1 – PRELIMINARY

Short title, extent and commencement – (1) This Act may be called the Chit Funds Act, 1982.

It extends to the whole of India except the State of Jammu and Kashmir.

It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint, and different dates may be appointed for different States.

2. Definitions – In this Act, unless the context otherwise requires.

(a)”approved bank” means the State Bank of India constituted under section 3 of the State Bank of India Act, 1955, or a subsidiary bank constituted under section 3 of the State Bank of India (Subsidiary Banks) Act, 1959, or a corresponding new bank constituted under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970, or a Regional Rural Bank established under section 3 of the Regional Rural Banks Act, 1976, or a corresponding new bank constituted under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980, or a banking company as defined under clause (c) of section 5 of the Banking Regulation Act 1949 or a banking institution notified by the Central Government under section 51 of that Act or such other banking institution as the State Government may, in consultation with the Reserve Bank, approve for the purposes of this Act;

(b)”chit’ means a transaction whether called chit, chit fund, chitty, kury or by any other name or under which a person enters into an agreement with a specified number of persons that every one of them shall subscribe a certain sum of money (or a certain quantity of grain instead) by way of periodical installments over a definite period and that each such subscriber shall, in his turn, as determined by lot or by auction or by tender or in such other manner as may be specified in the chit agreement, be entitled to the prize amount.

Explanation – A transaction is not a chit within the meaning of this clause. if in such transaction,

(a)some alone, but not all, of the subscribers get the prize amount without any liability to pay future subscription; or

(b)all the subscribers get the chit amount by turns with a liability to pay future subscriptions;

(c)’chit agreement ‘ means the document containing the articles of agreement between the foreman and the subscribers relating to the chit;

(d)’chit amount’ means sum-total of the subscriptions payable by all the subscribers for any instalment of a chit without any deduction of discount or otherwise;

(e)’chit business’ means the business of conducting a chit;

(f)’defaulting subscriber’ means a subscriber who has defaulted in the payment of subscriptions due in accordance with the terms of the chit agreement;

(g)’discount’ means the sum of money or the quantity of grain which a prized subscriber is under the terms of the chit agreement, required to forego and which is set apart under the said agreement to meet the expenses of running the chit or for distribution among the subscribers or for both;

(h)”dividend’ means the share of the subscriber in the amount of discount available under the chit agreement for rateable distribution among the subscribers at each instalment of the chit;

(i)”draw” means the manner specified in the chit agreement for the purpose of ascertaining the prized subscriber at any instalment of the chit;

(j)”foreman’ means the person who under the chit agreement is responsible for the conduct of the chit and includes any person discharging the functions of the foreman under section 39;

(k)’non-prized subscriber’ does not include a defaulting subscriber;

(l) “prescribed” means prescribed by rules made under this Act;

(m)”prize amount” means the difference between the chit amount and the discount, and in the case of a fraction of a ticket means the difference between the chit amount and the discount proportionate to the fraction of the ticket, and when the prize amount is payable otherwise than in cash, the value of the prize amount shall be the value at the time when it becomes payable;

(n)”prized subscriber” means a subscriber who has either received or is entitled to receive the prize amount;

(o)’Registrar’ means the Registrar of Chits appointed under section 61, and includes an Additional, a Joint, Deputy or an Assistant Registrar appointed under that section;

(p)”Reserve Bank’ means the Reserve Bank of India constituted under the Reserve Bank of India Act, 1934;

(q)”State Government”, in relation to a Union territory, means the administrator of the Union territory appointed by the President under article 239 of the Constitution;

(r)”subscriber” includes a person who holds a fraction of a ticket and also a transferee of a ticket or fraction thereof by assignment in writing or by operation of law;

(s)”ticket” means the share of a subscriber in a chit.

3. Act to override other laws, memorandum, articles, etc. – Save as otherwise expressly provided in this Act, –

(a)the provisions of this Act shall have effect notwithstanding anything to the contrary contained in any other law for the time being in force or in the memorandum or articles of association or bye-laws or in any agreement or resolution whether the same he registered, executed or passed, as the case may be, before or after the ‘commencement of this Act; and

(b)any provision contained in the memorandum articles, bye-laws, agreement or resolution aforesaid, shall, to the extent to which it is repugnant to the provisions of this Act become or be void, as the case may be.

CHAPTER IV – RIGHTS AND DUTIES OF NON-PRIZED SUBSCRIBERS

Non-prized subscribers to pay subscriptions and obtain receipts

Every non-prized subscriber shall pay his subscription due in respect of every instalment on the dates and times and at the places mentioned in the chit agreement and shall, on such payment, be entitled to obtain a receipt from the foreman.

Removal of defaulting subscribers –

(1)A non-prized subscriber who defaults in paying his subscription in accordance with the terms of the chit agreement shall be liable to have his name removed from the list of subscribers and a written notice of such removal shall be given by the foreman to the defaulting subscriber within fourteen days of the date of such removal:

Provided that if the defaulter pays the defaulted instalment with interest at such rate as may be prescribed within seven days of the date of receipt of such notice, his name shall be re-entered in the list of such subscribers.

(2)Every such removal under sub-section (1) shall within the date thereof by entered in the relevant book maintained by the foreman.

(3)A true copy of the entry referred to in sub-section (2) shall be filed by the foreman with the Registrar within fourteen days from the date of removal.

(4)Any defaulting subscriber aggrieved by the removal of his name from the list of subscribers may within seven days of the date of receipt of the notice of removal refer the matter to the Registrar for arbitration under section 64.

Substitution of subscribers:

(1)A foreman may substitute in the list of subscribers any person (hereafter in this Chapter referred to as the substituted subscriber) in place of the defaulting subscriber whose name has been removed under sub-section (1) of section 28.

(2)Every substitution referred to in sub-section (1) shall, with the date therefor, be entered in the relevant book maintained by the foreman and a true copy of every such entry shall be filed by the foreman with the Registrar within fourteen days from the date of substitution.

Amounts due to defaulting subscribers:

(1)A foreman shall, out of the amounts payable by and realized from the substituted subscriber towards the instalments relatable to the period before the date of substitution (including the arrears due from the defaulting subscriber), deposit before the date of the next succeeding instalment in a separate identifiable account in an approved bank mentioned in the chit agreement, an amount equal to the contributions made by the defaulting subscriber less such deductions as may be provided for in the chit agreement, and shall inform the defaulting subscriber as well as the Registrar of the fact of such deposit and shall not withdraw the amount so deposited except for payment to the defaulting subscriber.

(2)The amount so deposited under sub-section (1) shall be paid to the defaulting subscribers as and when he claims the amount and the amount so deposited shall not be withdrawn by the foreman for any purpose other than for such payment.

(3)The contributions of any defaulting subscriber who has been substituted till the termination of the chit shall be paid to him within fifteen days from the date of termination of the chit subject to such deductions as may be provided for in the chit agreement.

CHAPTER V RIGHTS AND DUTIES OF PRIZED SUBSCRIBERS

Prized subscriber to furnish security

Every prized subscriber shall, if he has not offered, to deduct the amount of all future subscriptions from the prize amount due to him, furnish, and a foreman shall take, sufficient security for the due payment of all future subscriptions and, if the foreman is a prized subscriber, he shall give security for the due payment of all the future subscriptions to the satisfaction of the Registrar.

Prized subscriber to pay subscriptions regularly

Every prized subscriber shall pay his subscriptions regularly on the dates and times and at the place mentioned in the chit agreement and, on his failure to do so, he shall be liable to make a consolidated payment of all the future subscriptions forthwith.

Foreman to demand future subscriptions by written notice

(1)A foreman shall not be entitled to claim a consolidated payment from a defaulting prized subscriber under section 32 unless he makes a demand to that effect in writing.

(2)Where a dispute is raised under this Act by a ‘foreman for a consolidated payment of future subscriptions from a defaulting prized subscriber and if the subscriber pays to the foreman on or before the date to which the dispute is posted for hearing the arrears of subscriptions till that date together with the interest thereon at the rate provided for in the chit agreement and the cost of adjudication of the dispute, the Registrar or his nominee hearing the dispute shall, not withstanding any contract to the contrary, make an order directing the subscriber to pay to the foreman the future subscriptions on or before the dates on which they fall due, and that, in case of any default of such payments by the subscriber, the foreman shall be at liberty to realise, in execution of that order, all future subscriptions and interest together with the costs, if any, less the amount if any, already paid by the subscriber in respect thereof:

Provided that if any such dispute is on a promissory note, no order shall be passed under this sub-section unless such promissory note expressly states that the amount due under the promissory note is towards the payment of subscriptions to the chit.

(3)Any person who holds any interest in the property furnished as security or part thereof, shall be entitled to make the payment under sub-section (2).

(4)All consolidated payments of future subscriptions realised by a foreman shall be deposited by him in an approved bank mentioned in the chit agreement before the date of the succeeding instalment and the amount so deposited shall not be withdrawn except for payment of future subscriptions.

(5)Where any property is obtained as security is lieu of the consolidated payment of future subscriptions, it shall remain as security for the due payment of future subscriptions.

All about Chit Funds

The name ‘Chit Funds’ typically makes many brows rise. They come under the media ire ever so often, and it’s time we unpack what’s behind this. Balussery has curated the information below to help dispel myths about this unique savings cum lending instrument.

So, what is a chit fund?

Chit Funds are classified as Miscellaneous Non Banking Financial Institutions under the RBI Act 1934, playing a major role in the National Financial Inclusion program even before the evolution of banking. This system, with numerous in built advantages, viz., easy accessibility, user friendly services; and free of latent cost, periodic interest hikes, exorbitant pre-closure charges, is the most preferred option, for those, who plan to save small amounts. Chit fund is a saving cum borrowing instrument, which is unique when compared to other financial products.

“Chit”, as defined by the act, means a transaction by way of which a foreman enters into an agreement with a number of subscribers that every one of them shall subscribe a certain sum of money in periodical installments over a definite period.

In his turn, as determined by lot or by auction or by tender or in another manner (as may be specified in the chit agreement), the subscriber is entitled to the prize amount.

History/ Legacy of the Chit Fund Concept:

The chit fund is totally an Indian concept. However, there are a number of versions of its history and its legacy.

A book written by Edith Jemima Simcox, entitled the ‘Malabar Kuri’ reinforces the fact that the system existed from ancient Dravidian times, being somewhat similar to the systems in China. In China, it developed into what is popularly known today as the Chinese lottery.

Another version of the origin of Chit fund is linked with Portuguese missionaries, who visited Muziris (Kodungallor) for evangelization and established a seminary at Vypeencotta village in 1577. They reportedly encouraged promotion of the chit fund in Kodungaloor.

There is also evidence to suggest that in earlier days, farmers took part in ‘grain funds’ (Dhanya Chittu), where grains were used instead of cash.

Evolution of the Chit Fund:

An indigenous financial institution peculiar to South India, Chit Funds found their way when banking and credit facilities were inadequate and people in general had to rely to a large measure on indigenous sources. Chit funds have been meeting a part of the genuine credit needs of the people, both in urban and rural areas.

The earliest systems of chits made use of lots. Presently, the systems of auctioning and tendering are more prevalent.

In 1969, the Government of Kerala set up the Kerala State Financial Enterprises Limited with the object of promoting chits. Mysore Sales International Limited, (MSIL) a Government of Karnataka Undertaking established in the year 1966, is also functional.

How Chit Fund companies work today:

Let’s look at the working of chit funds through the lens of an example.

Say, 25 subscribers agree to subscribe an amount of INR 2,000/- for 25 months i.e. for a total chit value of INR 50,000/-. In his turn and in a manner which is specified in the agreement, the subscriber begets his chit amount.

A simple formula helps us readily notice the working of chits:

Monthly Premium × Duration in Months = Gross Amount

In the above example, 2000*25=50,000/- which is called the chit value. The chit starts on an announced date, all the subscribers come together for the auction/lot.

During auction, subscribers in need, who are interested, bid by allowing percentage of subscription to be forgone.

The highest bidder i.e. who allows maximum percentage to subscribers is given the chit amount. After deducting a commission/remuneration to be paid to the foreman of the company, the amount foregone by the subscriber is distributed as dividend amongst all the subscribers in the draw.

Before the successful bidder draws the amount, he proposes securities – immovable properties, Life Insurance Policies, Bank Guarantee, etc., depending on the liability.

Chit Fund regulations in India:

Union of India has Act 40 of 1982, an enactment by the Central Government, which is administered by the respective State Government with the help of State Rules. The State can also seek advice and assistance from Reserve Bank of India on policy matters. There is an office of “Registrar of chit funds” in every State that monitors operation of the chit company minutely including the minimum capital requirement before the commencement of business, acceptance of security equaling to the chit amount in the name of Registrar before the commencement of each chit, restriction on the aggregate volume of turnover in relation to the net owned funds, restriction in the utilization and appropriation of the subscribers’ funds in the hands of the chit promoter, etc….

Any dispute touching the management of a chit business between the chit company and the subscriber shall be referred to by any of the parties to the dispute, to the registrar for arbitration and no civil court shall have jurisdiction to entertain any suit or other proceedings in respect of any such dispute. This enables a speedy redressal for the disputes as and when arises.

A study conducted by Institute of Financial Management and Research under the guidance of Dr.Mudit Kapoor, Indian School of Business, Hyderabad and Dr.Antoinette Schoar, MIT. Sloan School of Management, USA suggests that Chit Funds are an innovative access to finance for low-income households.

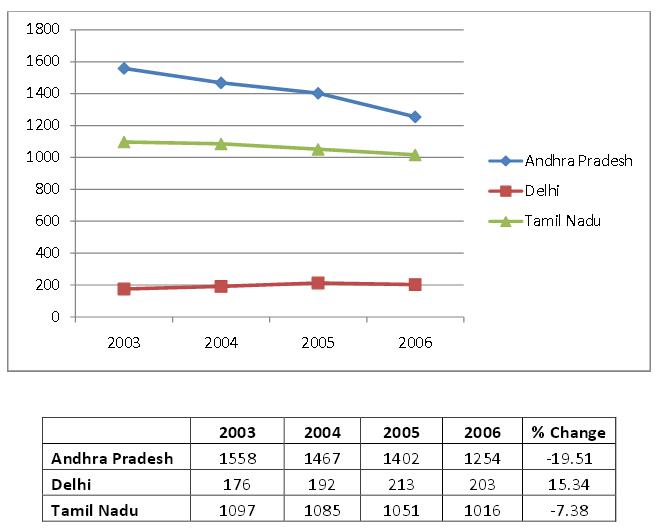

The estimated size of the Chit Fund industry is INR 35,000 crore and is growing.

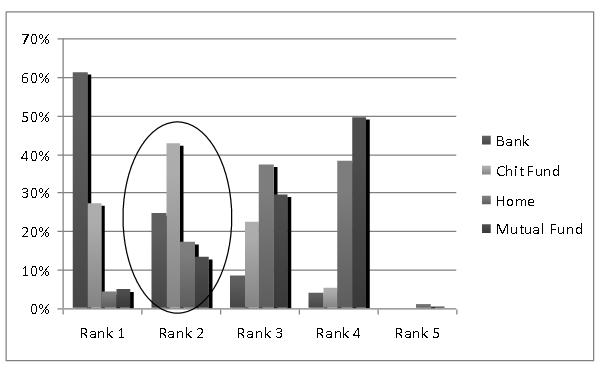

Overall ranking of preferred mode of savings according to the study:

As is demonstrated by the statistics above, chit funds are proving to be an increasingly popular mode of savings-cum-investment.

You can choose how much you want to save per month.

The rate of return is very high compared to other Investment Options and it is also secure form of Investment.

It inculcates the habit of saving and setting apart a particular amount every month towards investment for a rainy day.

There are also some tax benefits in chit funds.

Here is a more recent Business India article on how Chit Funds help in financial inclusion.

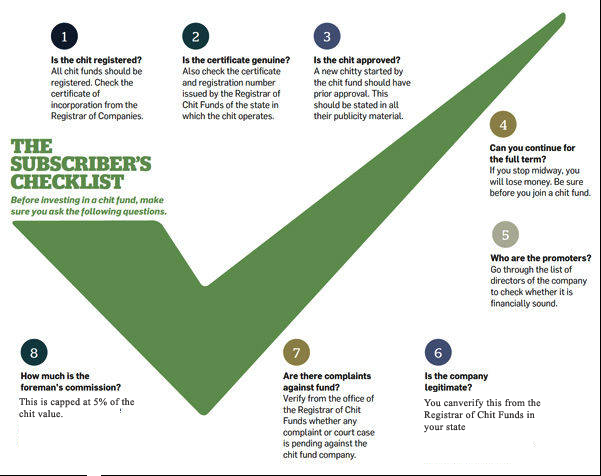

However, as with any relationship, it is important we tread the path with caution and with eyes open:

Yes! You Must Invest in Your Employees!

Chit Fund Schemes

Some people work for love; others work for personal fulfillment. Yet others like to accomplish goals or feel as if they contribute to something larger than themselves.Whatever their personal motivation for working, the bottom line, however, is financial security!

People are definitely a company’s greatest asset. It doesn’t make any difference whether the product is car or cosmetics.A company is only as good as the people it keeps.

Employee Benefits Plans That Help You Attract and Keep the Best Talent

Attracting and retaining high-quality employees is the key to your success, which is not possible in the absence of an attractive and well thought out employee benefits plan.

Employer’s Predicament

There must have been many an instances when your trusted employees approach you for monitory assistance, whether medical, school admission or housing. If you encourage this habit

– you feel bad. If you do not extend any help, they feel bad. Do you have a permanent solution for this?

Yes, Balussery!

You make them members in our chit plan and leave the worry to us. We’ll give your company tailor made chit plans. Your employees will have more choices and good quality options. They can select from the various models that suit them best. Our chit plans too come in all shapes and sizes.

Employer Benefits

Business organizations whose employees are happy are more productive, have a higher morale, and have a lower attrition rate.

More highly engaged employees

Employees willing to go above and beyond to meet organizational goals

Improved teamwork

Employees unlikely to be wooed away by competitors

No botheration of Staff advances/loans

Incentives/Revenue sharing

Shape your employees finances

Employees want to progress. Businesses need to provide a growth path, which becomes increasingly difficult in a shrinking economy. Its here we step in.

Employee Benefits

Inculcates Savings Habit

Debt-free life

Save & Borrow at the same time

Better Rate of Interest on loans

Higher returns on investments

Hassle-free availability of funds

No payment worries

Option of straight Deduction from Salary

Remember, it is loyalty that you are seeking.And it goes both ways!