FA CAPITAL MANAGEMENT PVT. LTD. "Meerlan Tower" 3rd Floor, Plot No: 33, Hanumantha Road, Balaji Nagar, Royapettah, Chennai - 600014

FA CAPITAL MANAGEMENT PVT. LTD.

"Meerlan Tower" 3rd Floor, Plot No: 33,

Hanumantha Road, Balaji Nagar,

Royapettah, Chennai - 600014

Email : info@facapital.co.in

Contact Number : 8754495075 / 9962000786

About Us

FA Capital Management Private Limited was established in the year 2008 by a team of professionals having a cumulative experience of 20 years in the Insurance & Financial Distribution industries.

Our Team is not only experienced but also professionally qualified in streams of Insurance, finance and investment management. We are an Exclusive General Insurance partner for the top General Insurance Companies in India. We have been one of the Pan India Top Channel Partners with most of the General Insurance Companies.

Now we are an organization with a team of 100+ employees with forte in insurance and a passion towards the finance and investment that we are perennially growing. We are one of the strongest Channel in retail segment and serving around 1000+ new customer along with our existing customers.

We are one of the Pan India top ranked channel Partners with ICICI Lombard and a member of the prestigious "CEO CLUB" of ICICI Lombard General Insurance Company. We are also a member of the "DIAMOND CRYSTAL CLUB" of HDFC Ergo General Insurance Company and a top ranked partner in Tamilnadu. We are also one of the leading channel partners with companies like Bajaj Allianz, Bharti AXA, TATA AIG and Magma HDI General Insurance Company.

Vision

To be most Successful and Reputed one stop Insurance Service and Solution Provider in India with an Unique Distribution Network in the Industry, which will penetrate all available insurance products and services to the customers and guide them with a Right Risk Solutions at their convenience.

Mission

Grow as an organization by delivering best insurance products and services which meets the customer expectations at right cost by applying technology, intelligence, and a human touch. We support our clients to manage risk proactively by intervene early and often by means of critical intelligence.

Values

In our commitment to public service, we value Fineness, Assurance, Integrity, Transparency and Humble.

Business Model

Our business schemes revolves around COFO model (Company Owned Franchise Operated Outlets) where we cater to our clients insurance and financial needs by means of physical outlets. Thus offering multiple products multiple services from insurance, mutual funds to wealth management to multiple locations all throughout PAN India. Our primary goal lies in Transforming Insurance Distribution Through Entrepreneurship (TIDE) by encouraging potential individuals to contribute to the insurance & financial needs of the thriving population by establishing our franchise and providing advisory solutions powered by technology.

Network & Technology Strength

Our network & technological strength at FA Capital tend to resolve the crucial bridge that connects the insurance providers and the insurance agents thereby helping them to track every milestone of their customer progress with defined documents and lead follow-ups. Our aggregate Software login allows the insurance agent to access all of his transactional, advisory and other customer-related data all under the same roof. Our self-service portal trails the entire end to end process from acquiring the clientele by sending proposals and also by tracking the lead by regular follow-ups at spaced intervals. We are proud of the architecture of our products, being profoundly secure, mobile responsive design. Thus helping the agents acquire leads with 24/7 assisting system, with remarkable speed in performance. Our cloud-based CRM is now providing the seamless process with the quote and compares along with the digital payment so for all the agents enrolled with us.

Insurance

Regardless of your financial situations, insurance policies are the crucial part of our life.

MOTOR INSURANCE

Our standard motor insurance or the so-called car insurance policy is usually administered as the insurance coverage mandated by law to drive on the road. It’s primarily to cover the vehicle against any liability damages and unexpected repairs.

Unlike just covering for the damages we offer a range of other utilities to the policy holders, as follows

Cashless claims at network garages

Depreciation cover

Engine protection cover

24X7 road side assistance

Towing facility

Cashless Claim settlement – This is the best part of our insurance policy, more like that of an health insurance, with a number of garages across the country providing the Cashless Claim Settlement. By figuring the nearest garage, the repairing claim can be done with contacting the insurer. Just incase the towing service is also being provided at conditions when a drive through is not being possible

HEALTH INSURANCE

Our Health Insurance / Mediclaim claims to offer coverage to the holder against medical expenses and emergencies. At times of critical medical needs, our mediclaim comes handy bearing on the medical expenditures might aswell be planned or unplanned costs.

Insurer can avail cashless facility claim, on visiting the network of hospitals. Our Healthcare plans are for covering both individual and families medical bills depending on the choice of policy ensuring that all hospitalization aspects are well covered.

TRAVEL INSURANCE

Our Travel insurance policy intends to cover for the expenses on medical, lost luggage, flight cancellation and even other losses during travel both domestic and international.

Apart from the above our policy covers the following expenses:

Medical expenses

Loss of baggage/baggage delay

Trip cancellation/delay

Loss of passport

Repatriation expenses etc.

What is not covered by us?

Self-induced injury

Illness caused of liquor, drugs etc

Aids and other sexually transmitted diseases

Pre-existing ailments

Travelling against the advice of physician etc

HOME INSURANCE

Our Home Insurance policy provides claim and coverage of the physical structure against the entire property and at times even to the property contents. There is a common misconception that a home insurance is only to be availed by the owners and not the tenants. But in reality our home insurance policy can also be adopted by the tenants for coverage on the contents of the properties. Thus a Comprehensive Home insurance policy is the need of the day for coverage against any eventualities.

Our home insurance policies provide policy buyers the option to purchase an insurance cover only for the structure/building or even for the belongings inside the house.

Our Home insurance policies also cover liabilities on any damage to the house and/or its contents cause of natural calamities, such as floods, fire, lightning, etc. or due to man-made reasons, such as theft, burglary, etc.

If not for an Comprehensive Home Insurance Policy the holder can also purchase a Fire Insurance policy from us to cover against fire and other accompanying damages. Although the degree of coverage offered by a comprehensive insurance plan is much greater.

A discount will also be offered by the us to the holder for choosing an insurance for the property and the contents.

As an addition, we also provide add-ons as Loss of Rent Cover, Temporary Resettlement Cover and more.

MARINE INSURANCE

Our Marine insurance policy covers the damages caused to the goods by shipping can also be the loss of cargo, ships and terminals. It also covers for the onshore and offshore property casualties and liabilities. In case of couriers, the shipping can be availed while processing the shipment. Our marine insurance policy offers to cover insurance to classification of transport means as follows:

Inland Transport

Import

Export

Sum Insured – or value of the policy would depend upon the type of contract. Usually, in addition to the contract value 10/15% is added to take care of incidental cost.

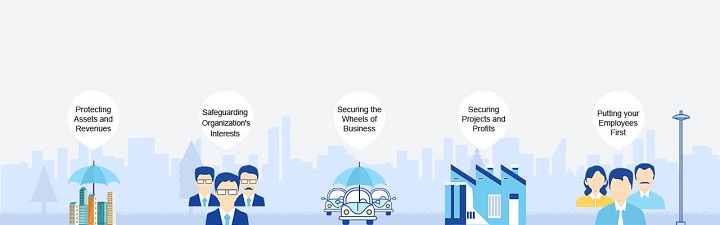

CORPORATE INSURANCE

We understand that Corporate insurance is by all means the most crucial part of the organisation and the most vital investment of the company, for protecting the organisation from any potential loss caused by the unforeseen and unfortunate circumstance including the theft, property damage, and the liabilities that follows also the coverage on business financial crisis and even for the medical claims of the employees of the organisation.

We do offer other several forms of liability protection for corporations including:

The policy would cover for the physical damage of the property both natural and other unpredictable situations

The risk of potential client or customer loss is covered if for any breach in the terms related to information, services and consulting

At times when consumer files a lawsuit against the organisation cause of injury or illness since the usage of the product, the policy offers coverage against the legal claims

An additional full coverage liability is being provided with Commercial Umbrella Insurance policy against the cost of claims when vital assets of the company are held in a lawsuit. At times when the cost of claims becomes unaffordable exceeding the business underlying primary insurance policy the umbrella policy assures to offer coverage so that the business owners out of pocket expenses.

Loans

Never let money stop you from getting closer to your goals.

PERSONAL LOAN

We understand the need of Personal Finance, individual saving and investing your money by means of budgeting, banking, insurance, mortgages, retirement planning, tax planning. Thus our financial services intent to individuals and households, and advises them about financial and investment opportunities.

We also Personal loans to salaried individuals with a reasonable cibil score to cover an individual's immediate personal need for funds. Even insecured loans are offered on an increased rate of interest.

What we offer?

Flexible repayment options.

Flexible tenure options up to 60 months.

Maximum loan amount of Rs 50 lakh.

No collateral required to avail of the loan.

Co-applicant options available

Interest rates remain constant until the loan tenure.

VEHICLE LOAN

HOME LOAN

Procuring your home loan is hassle-free with us. No matter your existing financial aids, and the property of purchase, our financial experts would take you through the process of home loan at competitive interest rates. We propose legal and other assistance throughout the entire process to realising the dream of your very own home. Under our home loan umbrella, your home loan can be classified

Purchase Loan

Improvement Loan

Construction Loan

Land Purchase Loan

Extension Loan

Joint Home Loan

Home Loan Balance Transfer

Top-up Home Loan

Investments

Augmenting the income has always been the call of our day, the accessible ways of doing it is to invest in potential sources.

MUTUAL FUNDS

We as a mutual fund company pool money from investors and invests the same in securities such as stocks, bonds, and short-term debt even offering combined holdings of the mutual fund are known as portfolio with Each share representing an investor’s part ownership in the fund and the income it generates. Our mutual fund policy fall into four main categories – money market funds, bond funds, stock funds, and target date funds with Each type has different features, risks, and rewards.

Money Market Funds : They have relatively low risk. The investment is bound to certain norms of the federal state government pertaining to high-quality & short-term investment.

Bond Funds : They typically aim at producing high returns with a much higher risks than the money market funds. Depending on the type of bond, the risk and rewards are subjective.

Stock Funds : These are the funds invested in corporate stocks. Some examples are income funds, index funds, sector funds, growth funds.

Target Date Funds : It’s the hold a mix of stocks, bonds, and other investments. With time, the mix gradually shifts according to the fund’s strategy and is mostly constructed for individuals with particular retirement dates.

WEALTH MANAGEMENT

Our Wealth management schemes intends to help with investment planning and advisory for high-end net worthy clients. Our Wealth management offers to combines both financial planning and specialized financial services, including personal retail banking services, legal and tax advice, and investment planning services and our Personalised investment services focus on developing strategy to meet individual financial goals.

To begin the initial process commences with consultation with the wealth managers to identify the investment product on the bases of the client profile with respect to the individuals financial situation, risk appetite and objectives. The management is mostly around investments such as bonds, equities, investment funds, structured notes and more

Portfolio Management Services

PMS under our management umbrella offers wealth management services to wealthy investors with high flexibility and customisation, Our PMS service aims to generate relatively high returns in comparison to other investment avenues focusing on the same asset bases.

Our Discretionary PMS is one in which the manages acts autonomous to manage the investments of the client. Unlike the above Non-discretionary PMS, the manager is not committed to take discretion at his own disposal whereas he is to refer to the clients approval for all transactions.

Profit Sharing : The profit sharing for the portfolio manager happens on the basis of High watermark Principle so and so the manager does not get paid for the low performance on investment.

Breaking down the high water mark principle.

Assuming the investor places 5 lakhs into the fund and agreed on 20% fee to the portfolio manager. The fund makes a profit of 75K in the following month, owing a fee of 15K. Thus making the high watermark for this investor to be 575000, assuming the fund loses 20% in the next month and the account drops value to 460000. The performance fee need not be paid to increase the fund from 460000 to 575000, the fee is to be paid only if the fund increases above 575000. The importance of the high watermark lies in this structure of fee.

PENSION FUNDS

Pension Plans with us covers retirement plans investing a part of your income into a dedicated policy. With us, you may invest some portion of your income into the designated plan with the main goal of regular income post retirement.

The pension plans have two stages – the accumulation stage and the vesting stage. Initially the investors tend to pay annual premiums until the time their retirement. After the retirement at the second stage,the vesting stage begins. During which the retiree will start receiving annuities until the time of their death or that of their nominee.

STOCKS AND SECURITIES

Our unique stands lies in immediate processing time along with compelling interest rates. And with no requirement of any other collateral except the investment securities acquiring finance for. At times of needing instant cash flow to invest in your business needs, we take you through our process of immediate funding on your securities without having to give up on your investment.

Equity Securities (Stocks)

Debt Securities (Bonds)

Derivative Securities

Securities are that which can be traded on an exchange. When your company is under financial stress, getting a loan from a bank would be an option. If so that debt has to be paid in the scheduled time and it can’t be traded. Whereas the bank could sell the loan to another company if needed.If you are a business needing money (financial capital) to expand, you can get a loan from a bank, that is one option. The bank then gives you a loan of, say, $1,000,000. You then will pay back the loan to the bank on schedule. This is a bank loan, and it can't be traded, although the bank might sell your loan to another bank if it wanted to. The capital markets raises money, after the process through an investment bank.

REAL ESTATE INVESTMENTS

We understand the importance of real estate investment owning to its instant cash flow and liquidity so we classified our investment plan including residential real estate investing, commercial real estate investing, industrial real estate investing and retail real estate investing.

Real Estate Investment Trusts The investment can be done through trust called RIET’s. It s mostly bought through brokerage account or any custody account. The tax structure is unique that it encourages small investors, the profit margin for the holders is also relatively high.